If you wish to generate income by investing in bonds while also enjoying the safety of not putting all your eggs in one basket, you may want to consider building a bond ladder. Through this financial strategy, you can purchase individual bonds that have various maturity terms to get a blended rate. As we all know, it’s extremely difficult to predict when interest rates will rise or fall, which can make investors hesitant to take action. But doing nothing means you could miss out on potentially high yields. That’s where a bond ladder can help. The financial advisors at Miser Wealth Partners have extensive experience in helping their patients earn steady income with bonds.

What is a bond ladder?

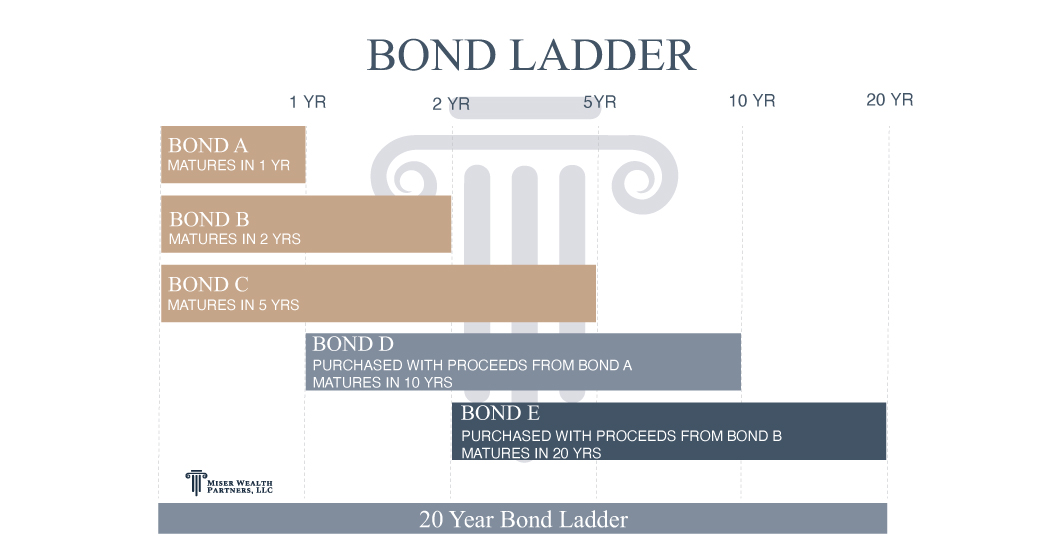

To put it simply, a bond ladder is a portfolio of multiple bonds that mature on different dates. These maturity dates are evenly spaced across several months or years so that the proceeds are reinvested at regular intervals as the bonds mature.

For instance, let’s say you build a 10-year bond ladder with a bond maturing every year. As the bonds at the lower end of the ladder mature, that money can be reinvested at the higher end of the ladder with the new long-term bonds. If interest rates have gone up, you’ll be able to take advantage of those higher yields upon maturity. If rates have fallen, on the other hand, you’ll still have the higher yielding bonds in your ladder to help smooth out the effects of the market volatility.

How can a bond ladder benefit my portfolio?

By spreading out maturity dates of your bonds, it can help prevent you from the very difficult task of trying to time the market. If you stay disciplined and reinvest the proceeds from maturing bonds at the right time, it can help you ride out any interest rate fluctuations. Furthermore, a bond ladder can help increase liquidity as well as diversify your portfolio.

Does a bond ladder protect against loss?

While a well-diversified bond ladder does not guarantee you will avoid a loss, it can help protect you the way that any diversified portfolio does – by helping limit the amount of funds in any single investment.

How many bonds should I have in a bond ladder?

The specific amount of bonds will, of course, depend on your personal financial goals and the amount of money you’d like to invest. Generally speaking, however, an investor should aim to have at least 10 bonds, or “rungs,” in their bond ladder. The more rungs in the ladder, the higher the diversification, liquidity, and yield stability.

Can a bond ladder help manage my cash flow in addition to managing interest rate risks?

Yes, it can. Because many bonds pay interest twice per year on dates that typically coincide with their maturity date, you can potentially structure regular bond income by creating a ladder with a mix of short- and long-term bonds that generate monthly income. With a bond ladder alone, it would take a large portfolio to meet all of most investors’ income needs. But, over time, a bond ladder can help you manage in a changing interest rate environment.

Ready to diversify your portfolio and earn income with a bond ladder in East Tennessee?

As we’ve explained, owning bonds with varying maturities can help provide you with a source of predictable income, even if rates decrease in the future. Learn more about the unique strategy of bond laddering and how it can help boost your portfolio by contacting the experts at Miser Wealth Partners today. Call us at (865) 281-1616 or click here to set up a meeting at a time that works best for you.