The most important element when it comes to financial planning is your budget, and proper income allocation is an extremely important aspect to ensure your money is distributed where it will foster the most benefit. The financial planners at Miser Wealth Partners have extensive experience in income allocation for our clients in Farragut, Tellico Village, and all of East Tennessee.

What exactly does income allocation mean?

Wealth management income allocation refers to the process of dividing and distributing a person’s or entity’s income among different investment or financial instruments to achieve specific financial goals and optimize returns while managing risk. The primary objective is to create a diversified portfolio tailored to an individual’s risk tolerance, time horizon, and financial objectives.

What steps are involved in income allocation?

The income allocation process typically involves the following steps:

- Assessing financial goals and risk tolerance: Our advisors start by understanding the client’s financial goals, such as retirement planning, buying a home, funding education, or preserving wealth. Additionally, we assess the client’s risk tolerance to determine how much volatility they can handle in their investments. Assessing financial goals and risk tolerance is crucial for effective financial planning. Factors like age, income, and family situation influence these assessments. A balanced approach, considering both short-term and long-term goals, can lead to a well-rounded financial plan that maximizes returns while minimizing potential risks.

- Asset Allocation: Once the goals and risk tolerance are established, the next step is to determine the appropriate asset allocation. This involves dividing the portfolio among different asset classes, such as stocks, bonds, cash, real estate, and alternative investments like private equity or hedge funds. This diversification balances risk and reward, optimizing returns while reducing overall volatility. By spreading investments across various assets, investors can potentially achieve more stable long-term growth and better withstand market fluctuations. The asset allocation decision is crucial as it has a significant impact on the portfolio’s overall performance.

- Income-Generating Investments: Income allocation involves identifying specific investments within each asset class that are designed to generate regular income. For instance, in the equity portion, dividend-paying stocks or equity income funds might be considered. In the fixed-income segment, bonds or bond funds with regular coupon payments could be included. Rental income from real estate properties is another example of income generation.

What strategies are involved in asset allocation?

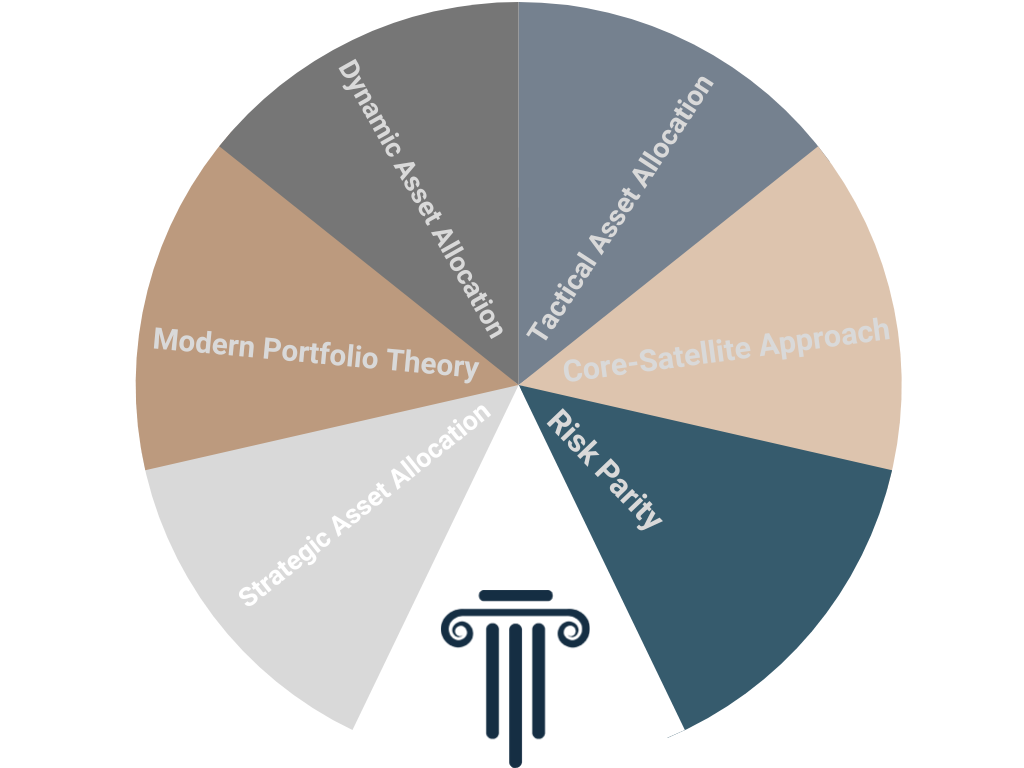

Asset allocations typically involve the following six strategies:

- Modern Portfolio Theory (MPT): Utilizing mathematical models to optimize asset allocations based on risk and return expectations.

- Strategic Asset Allocation: Creating a fixed, long-term allocation plan aligned with an individual’s financial goals and risk tolerance.

- Tactical Asset Allocation: Making short-term adjustments to the portfolio based on market conditions and economic outlooks.

- Risk Parity: Allocating assets to achieve equal risk contributions from each asset class, promoting balanced diversification.

- Core-Satellite Approach: Combining a diversified core portfolio with satellite investments targeting specific opportunities or themes.

- Dynamic Asset Allocation: Adapting allocations based on market trends and asset performance, aiming to capitalize on market inefficiencies.

What other considerations are involved with income allocation?

Our advisors can also help with the following as part of the most advantageous income allocation:

- Rebalancing: Over time, the performance of different investments within the portfolio will vary, leading to shifts in asset allocation. Regular portfolio rebalancing ensures that the allocation aligns with the client’s financial objectives and risk tolerance. It involves selling some assets and buying others to maintain the desired income allocation.

- Tax Considerations: Wealth managers also consider tax implications when allocating income. Different types of investments have varying tax treatments, and tax-efficient strategies are employed to maximize after-tax returns.

- Review and Adjustment: As the client’s financial situation or market conditions change, the income allocation strategy may need adjustments. Regular reviews with the client help ensure that the portfolio remains aligned with their changing needs and goals.

Why choose Miser Wealth Partners to manage my income allocation?

Income allocation is just one aspect of a comprehensive wealth management strategy. Other components, such as estate planning, risk management, and retirement planning, play vital roles in creating a well-rounded financial plan tailored to an individual’s unique circumstances. Therefore, seeking advice from qualified financial professionals is crucial for an effective wealth management income allocation approach. That’s where we come in.

How can I get help with my income allocation in East Tennessee?

If you’re ready to get the most value for your dollar through proper income allocation, then we invite you to schedule a meeting today.