Q: Barbara asks, “Dear Derek, I have always been a long-term investor, but as I enter retirement what risks should I be aware of and how can I avoid them?”

A: Congratulations on reaching retirement, Barbara! Let the fun begin, right? That may be true, but it is time to eliminate the six biggest risks from your retirement. Like, “Do I really have enough money to retire?” “Could I outlive my savings?” “What if I have a healthcare event and need care?” “What if my trustee loses their capacity to perform, could my access to inherited money change?” “What if inflation begins to rise?” “Should I be concerned about interest rates?” “What if the market corrects, how could that affect the viability of my long-term retirement lifestyle?” “What if my heirs predecease me, where does my money go?” And finally, “What if tax rates increase?”

You’re right, Barbara, one has much to consider when one decides to embark into retirement. I am going to walk you through the six biggest risks that every retiree must eliminate when they decide to retire to ensure they can, in fact, “retire happy!”You will be amazed at how many of your neighbors have overlooked these devastating risks. Too often, it may be because they have an advisor that they have worked with for years whose primary focus has been growing their wealth and isn’t truly equipped to strategically advise them on how to mitigate these risks and ensure the most tax-efficient transition plan for their wealth?

Risk #1 Withdrawal Rate Risk

Whatever happened to “happily after, after?” Retirement risk seems to be around every corner. One of the “Big 7 Risks” is Withdrawal Rate Risk. Am I taking out too much from my savings and am I taking it from the right bucket(s). Bill Bengen, the author of the 4% Rule, once stated that it was safe to take 4% annually from your savings, and statistically, your probability would be nearly zero. Well, that was in the ’90s when markets were booming and the theory was that “even a monkey could earn 10% annually with their eyes closed” was the favorite “kool-aid” everyone was euphorically consuming. Then 2000 hit and over the next three years, we all learned that was not true. A matter of fact, the entire decade from 2000-2010, became known as the “lost decade.” The total return over that period of time was

Are you withdrawing 10%, 5%, 4%? Would you be surprised to learn that the Wall Street Journal published an article entitled, “Say Goodbye to the 4% Rule,” that recently studied the markets to find actually a 2% withdrawal rate was now the “bulletproof” withdrawal rate? That means that for every million dollars you have saved you can safely withdrawal $20,000 annually. Retirees living on taking $50,000 of withdraws from their savings would have to have accumulated $2,500,000.

Risk #2 Purchasing Power Risk (aka. Interest Rate Risk)

Have you accounted for inflation risk that will creep higher as our National Debt exceeds $27,000,000,000,000? Will oil prices rise in the future affecting the price of gasoline in the coming years? Will health care prices continue to rise for basic services?

Interest Rate Risk is a dangerous risk to overlook when managing your retirement. This risk affects you in many ways. It is stealing returns on your cash equivalent investments. Just look at what banks are paying for products like certificates of deposits. It can affect what rates you are eligible for in the current annuity market. Distribution rates and crediting rates within insurance solutions can be adversely affected when rates are low.

Risk #3 Sequential Risk (aka. Order of Returns Risk)

I could write an entire post on this one risk. It is one of the most destructive risks and one that is seldom discussed when advisors are in front of retirees. You, see once you retire, the concept of averaging a “10%” return goes out the window. When begin withdrawing money from your savings “all bets are off.” The order of returns that one achieves annually can have a significant impact on the success or failure of their retirement. It can determine if they are on the golf course at 80 or bagging groceries. Let’s take a look at two siblings and how different their outcomes were even though they followed the exact same plan.

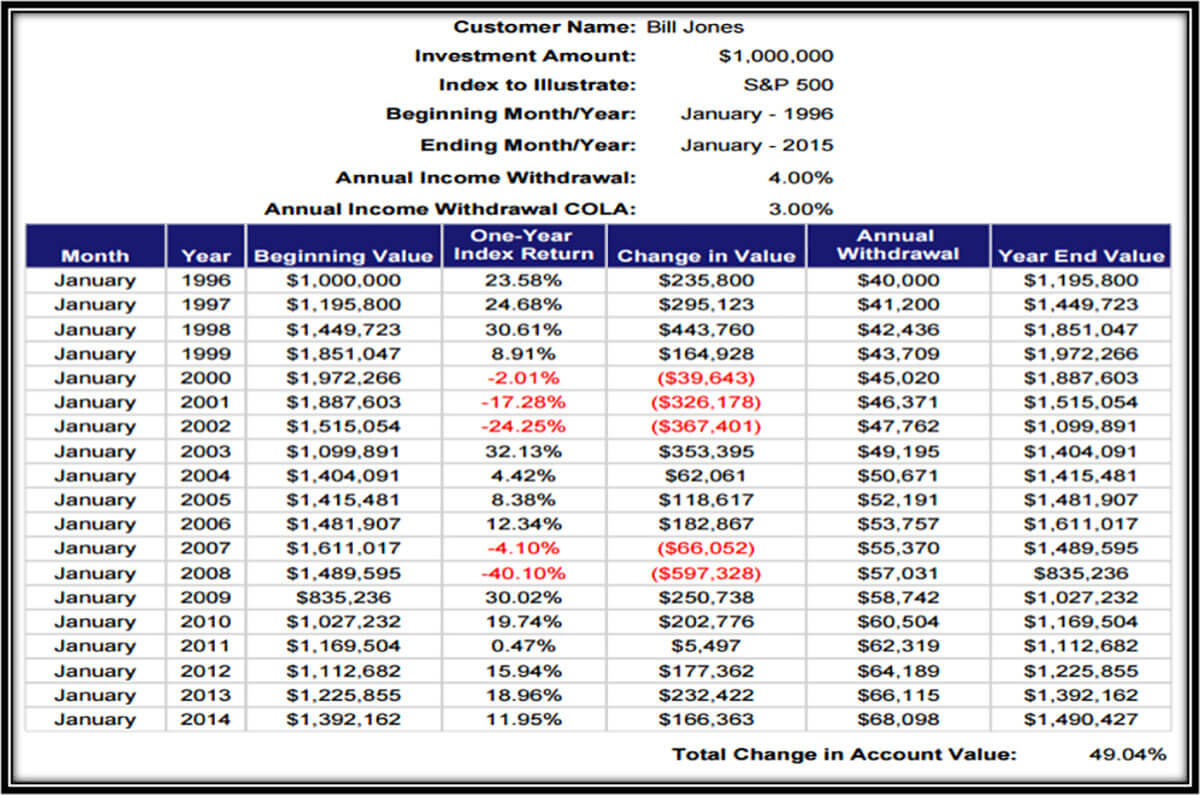

First, we have Bill. Believe it or not, but Bill lived in Michigan before he retired here in Tellico Village in 1996. He was 60 when he and his wife Betty first retired. Bill had saved $1,000,000 and only invest in S&P 500 ETFs. He and Betty withdrawal 4% annually and try to increase their withdrawal amounts by 3% annually to keep pace with inflation. Let’s take a look at how that strategy has worked for Bill and Betty:

As you can see that Bill and Betty’s plan has worked out fairly well. They immediately saw three years of very positive growth in their balances. 2000, 2001, and 2002 were tough years, but they end that period with still more than they had started in 1996, even though they had withdrawn over $300,000 from their portfolio over that same period. The benefited from a bounce-back in 2003 and we doing well until 2007 and 2008 but were still in good shape with again more than they started with while having now withdrawn over $700,000 from the original investment they made back in 1996. Overall, through 2014, Bill and Betty had enjoyed over a nearly 20 year period a positive change in their accounts by over 49% in spite of withdrawing over $1 million over that same period to live on.

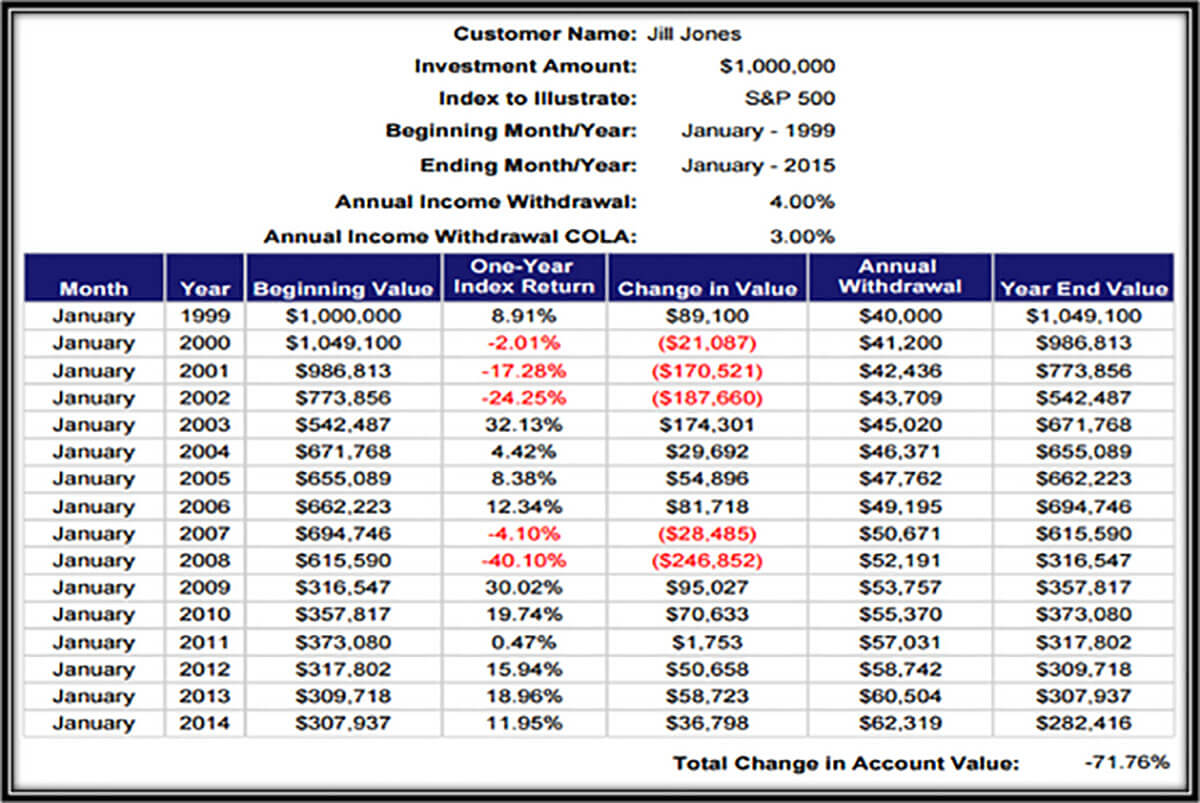

As you can see the returns are the same, the withdrawal rates are the same; however, Jill experienced significant downturns almost immediately upon retirement in years 2, 3, and 4, from 2000 to 2002 respectively. The timing of these losses was catastrophic to the viability of Jill’s long-term success. Her account had peaked in 1999, but now is were almost 50% of its high-water mark. Fortunately, 2003 (+32.13%) was a good year for her, but her portfolio only recovered approximately 17%+ from where she originally began. When 2008 hit her portfolio, Jill had to begin thinking about what she was going to do to supplement her income if she were to outlive this bucket of savings.

Sequential Risk is a serious matter. The good news is there is a way to avoid this risk entirely. Feel free to email me at info@miser-wp.com to learn how.

Risk #4 Disability Risk

Healthcare as we all know is an important part of any retirement plan. Neglecting to plan for such an event can be devastating to your retirement future. Think about that even if an individual does a good job of planning and saving it could be all for naught if the plan is not protected from the possibility of disability long-term care needs or other risks. Let me make this as clear as possible. No retirement plan is complete without a plan for long term care policy. For many seniors it’s the only thing they have not planned for that could completely wipe out their entire life’s work and savings.

Think about it for a minute if your house burned to the ground it would be an emotional loss but your insurance would cover to move or rebuild. If you totaled your car you may have some physical injuries but the insurance company would help protect you from lawsuits and replace your car but what would happen if you needed full-time around-the-clock care to help you live your life. What would that cost be and how long would your savings last. What would happen to your spouse and family?

Now here are some interesting statistics relate to the odds your home might burn down between now and the day you die. Did you know those odds are about 3 out of a 100 but nearly every homeowner has homeowners insurance, The odds of you totaling your car between now and the day you die are about 18 out of a hundred yet nearly every automobile owner carries auto insurance, but the odds that you will need some form of long term care between now and the day you die are about 72 out of a hundred however less than 30% of Americans over the age of 45 have purchased long-term care insurance?

Risk #5 Market Risk

One of the biggest risks in retirement is being exposed to unknown risks. What do I mean by this? I mean not being aware of working with an advisor who understands how to protect 100% of your principal and stay fully invest in the market. Does that seem like a paradox? It’s not! Wealthy retirees have known this for some time now and you need to understand how to grow your wealth without risk. When you understand how to eliminate this risk from your mind, your enjoyment of everyday life improves. I want to warn you that the reason you may not be aware of how to implement into your life, maybe that your advisor has a conflict with the growth of his wealth and yours. I know that may seem funny, but it may be the case. The other reason is that they may not be able to introduce such an idea because they work for an institution that doesn’t offer or desire for you to invest in this manner. It may not fee its corporate mission. The truth of the matter is that you can access this info, by emailing me at info@miser-wp.com Together we can work to eliminate this risk from your retirement almost immediately.

Risk #6 Longevity Risk

Longevity is not just a risk, it is a risk multiplier. The longer you live the more likely the markets will crash. The longer you live the more likely interest rates will rise. The longer you live the more likely you may be withdrawing too much money. The longer you live the more likely you will have a healthcare event. The longer you live the more likely your purchasing power will erode. The longer you live the more likely you will outlive your savings.

The fact of the matter is that the average retirement last 18.1 years. The average life expectancy of a 65-year-old male is age 85. The average life expectancy of a 65-year-old female is age 88. The average life expectancy of a 65-year-old couple is that one of them will live to be age 92. Longevity risk is real, but I have a way to eliminate it from your life. Email me at info@miser-wp.com to learn more.