Q: Jim recently asked, “Dear Derek: I have multiple investment advisors, however, they focus primarily on growing my wealth, I curious what financial moves have you been advising your clients to do during this pandemic period we are living in today?”

A: Thank you for your question, Jim. My clients are highly active in these four areas as 2020 is nearing its end.

1. Asset protection planning to insulate their assets from litigation, fraud, as well as potential creditors or former spouses that might pursue assets, they pass to their heirs in the future.

2. The need to implement year-end trust planning for those with heirs who reside within states with high state income tax rates such as New York, California, Oregon, and Illinois, etc. to avoid future state income tax on the 401k, IRA, or other qualified accounts they inherit. 3. I am addressing the best means to harvest losses and gains within their entire balance sheet to reduce their future tax liability in 2020 and beyond. 4. How to optimize their wealth transfer via the 2019 SECURE Act and still be able to stretch-out their non-spousal distributions to the heirs even though that was technically eliminated via this Act in 2019.

Jim, I realize these may seem like unique topics versus the type of conversations you may be having with your local retail advisors; however, in larger US markets, these are the priorities that the largest and most sophisticated law firms and financial advisors like me are working to deliver to their clients as 2020 comes to a close.

Asset Protection Planning

Asset Protection works by removing the economic incentive for a person, and that person’s attorney to pursue you in a court of law. The best way to protect your assets is to take legal steps to make you unattractive to potential predators. Too few advisors lack the experience to introduce the need for asset protection to their clients. Too often the discussion centers around their belief that you simply need a $1 million umbrella policy to solve your asset protection risk. The fact is that an umbrella doesn’t deter anyone from pursuing your assets. The umbrella is only a safety net that you deploy after the event has occurred.

Proper asset protection deters risk. How you title your assets and how you control this asset is important. Yes, quality asset protection may cost $10,000 or more, but that is pennies when you could lose the bulk of your estate to fraud, theft, divorce, litigation, or creditors.

Don’t let your real estate, tax, or divorce attorney convince you that they are a specialist when it comes to asset protection. I work with a number of leading asset protection attorneys in the US. They lecture at premier wealth conferences around the world and with my introduction, they will provide you an affordable discounted rate to protect your estate. Below is a testimonial video from Doug Lodmell, who is the managing partner for Lodmell & Lodmell, PC. I would be happy to arrange a free call with Doug for you to discuss your asset protection concerns.

Video: Lodmell & Lodmell Testimonials

Income Tax Avoidance for Heirs who Reside within High-income Tax States

Currently, some income-tax rates within many states ranged from the lowest top rate of 2.90% in North Dakota and 3.07% in Pennsylvania to the highest top rate of 9.90% in Oregon, 12.696% in New York City, and 13.3% in California. With proper planning, this tax may be minimized or eliminated in many instances. Conversely, without proper planning, the income of a trust might be subject to tax by more than one state.

Even where only one state is involved, trustees pay a lot of state income taxes. For example, in 2014 (the latest year for which figures have been released), 59,685 resident fiduciaries paid $342,062,000 of New York income tax. Given that the rules for exempting trusts from taxation are straightforward, one wonders how much of that tax could have been saved.

In many situations, the potential benefits of eliminating state income tax by trustees are clear. For example, if a non-grantor trust, which had a California trustee but no California beneficiaries, incurred a $1 million long-term capital gain, had no other income, and paid its California income tax by the end of the year, the trustee would have paid $108,775 of California income tax and $232,860 of federal income tax. If the trust had a non-California trustee, however, the trustee would have owed $0 of state income tax and $236,514 of federal income tax—a difference of $105,121, or over 30% less!

Similarly, if a non-grantor trust, which was created by a New York City resident and was subject to New York State and City tax, incurred a $1 million long-term capital gain in 2019, had no other income, and paid its New York State and City income tax by year-end, the trustee would have owed $107,124 of New York State and New York City tax on December 29, 2019, and $232,922 of federal income tax on April 15, 2020. If the trust had been structured so that the New York tax was not payable, however, the trustee would have owed no state or city tax and $236,514 of federal income tax—again, over 30% less.

This planning can significantly preserve your family’s wealth. If you have heirs who reside in some of these states, there are real solutions to save taxes on your qualified savings. Don’t procrastinate and let your hard-earned dollars fund the tax coffers instead of your family’s future.

Tax Loss/Gain Harvesting

The holidays are coming and before you know you may miss some strategic opportunities to harvest your available tax bounty related to your gains and/or losses within your investment portfolio.

Seems simple enough, but it’s not. The difficulty in deciding on whether or not to harvest gains comes when the taxpayer was not planning on selling the asset for two, three, or more years. It becomes a battle between two competing benefits: paying tax at a reduced rate and loss of tax deferral. The best way to analyze these competing benefits is to think about gain harvesting as an investment in the current year to buy tax savings in a later year. This allows for a calculation of the rate of return on this investment.

Usually, if the taxpayers originally planned on selling the assets in the following year and they are in a lower tax bracket this year than they will be in next year, gain harvesting can be very beneficial. If the planned sale was farther in the future, however, loss harvesting may or may not be beneficial. The key variables to consider in deciding whether to harvest gains are:

- The time period between the gain harvesting sale and the sale of the repurchased assets (i.e., the period of time between the sale in the current year and the sale in the originally planned year);

- The difference in the taxpayer’s tax rates between the two sales;

- The growth rate of the stock; and

- The taxpayer’s opportunity cost of capital.

As stated above, the shorter the time period between the gain harvesting sale and the originally planned sale, the more favorable gain harvesting will be. The decision of whether to harvest gains will be based on the taxpayer’s return on investment compared with his or her opportunity cost of capital (the return he or she could have earned on the best alternative investment of comparable risk).

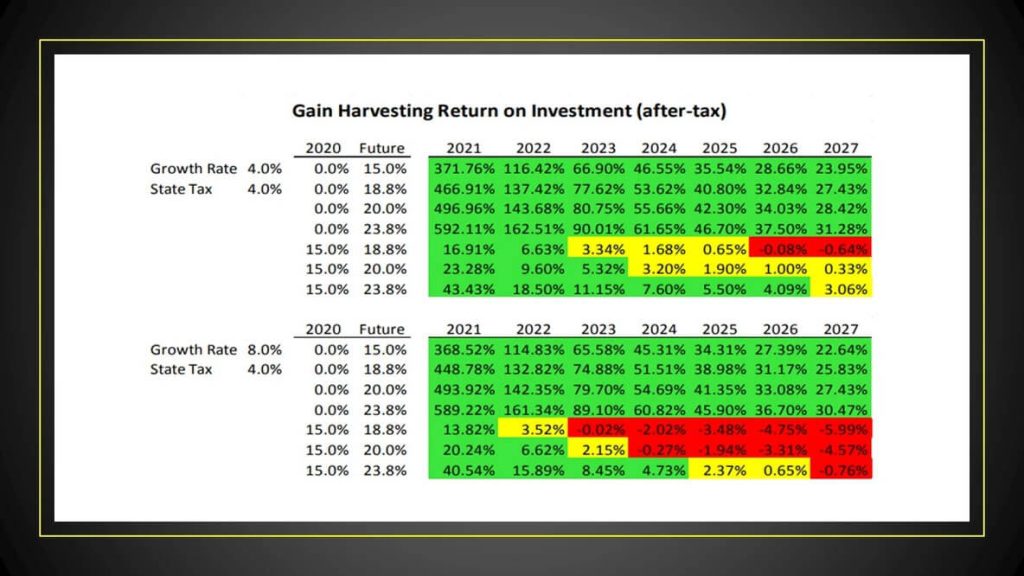

I have developed a Gain Harvesting Return on Investment calculator that allows retirees to quickly see what the return on investment of gain harvesting will be depending on the combination of the various variables mentioned above:

- The time period between the gain harvesting and the subsequent sale;

- The tax rate in the current year versus the tax rate in the year the asset will be sold;

- The asset’s growth rate; and

- Any state tax rate.

Shown below is a sample screenshot of the results produced by the calculator.

Most importantly, if the taxpayer is currently in the 0% capital gains tax bracket, gain harvesting will always be favorable because it gives the taxpayer a free basis step-up. Thus, always make sure to fill up the 0% capital gains tax bracket. Furthermore, if the taxpayer is nearing death and plans on keeping the asset until death to pass it on to his or her heirs, then there is no reason to harvest gains now because the taxpayer (or his heirs) will get a free stepped-up basis at the time of the taxpayer’s death.

Lastly, before engaging in gain harvesting, be sure to take a look at the economic substance doctrine. IRC § 6662(b)(6) imposes a 20% penalty on any underpayment of tax due to a transaction that lacks economic substance. That penalty increases to 40% if the transaction is not adequately disclosed on the return. IRC § 7701(o) provides that a transaction has economic substance only if: (1) it changes the taxpayer’s economic position in a meaningful way; and (2) the taxpayer has a substantial non-tax reason for entering into the transaction.

If you looking to strategically reduce taxes before the end of the year, this the type of technology you need to do so. Email today at askme@dearderek.com and let’s explore if harvesting your gains and/or losses could be beneficial to your wealth.

Distribution Planning for Non-Spousal Inherited IRAs Following the SECURE Act.

The stretch IRA was the ideal method for maximizing the time during which IRA assets could grow on a tax-deferred basis for non-spouse beneficiaries. Although the SECURE Act eliminated the stretch IRA for most non-spousal inherited IRAs, generally requiring that the full value of the IRA be distributed within 10 years after an IRA owner’s death, several strategies are still available to increase the amount that can be accumulated for a family. These strategies include (1) naming a charitable remainder trust as the IRA beneficiary, (2) Roth IRA conversions, (3) buying life insurance, (4) multi-generational spray trusts, (5) incomplete gift non-grantor trusts, and (6) IRC § 678 trusts.

Instead of going in-depth into each of the effects of such planning. I recommend you email me at askme@dearderek.com to arrange for some discovery of your situation to best derive what strategies may be most beneficial for you.