UNDERSTANDING THE NUMBERS

“The hardest thing in the world to understand is the income tax.”

–Albert Einstein

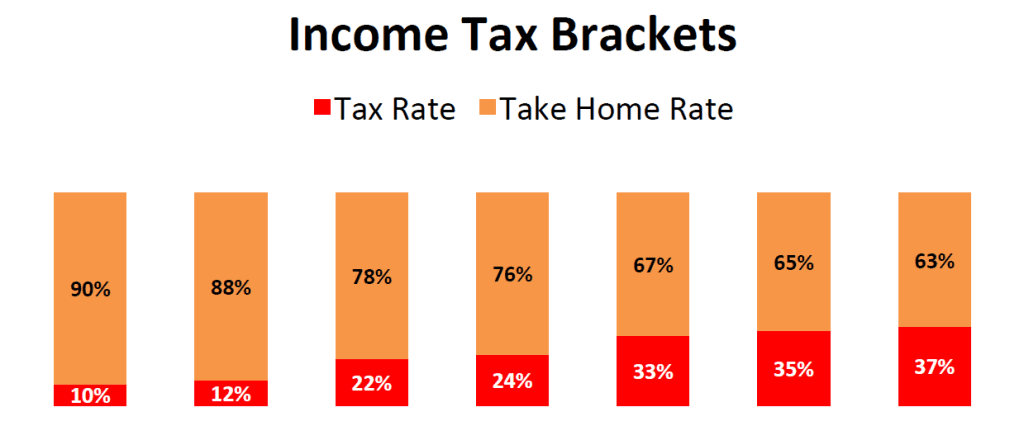

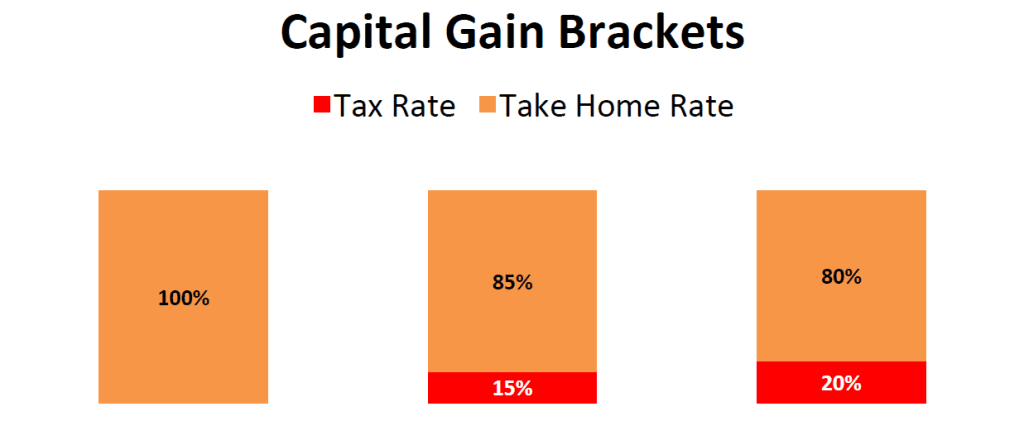

Following the 2017 Tax Cuts and Jobs Act, there are seven different ordinary income tax brackets – 10%, 12%, 22%, 24%, 32%, 35%, and 37% – and three different capital gains tax brackets – 0%, 15%, and 20%.

If you combine these tax brackets with the 3.8% net investment income tax (NIIT), there are even more possible tax brackets; i.e., high-income taxpayers will be subject to a 40.8% tax rate on ordinary income and a 23.8% tax rate on long-term capital gains. A large number of tax brackets and the steep cliffs between some of them make tax deferral and income smoothing strategies a must.

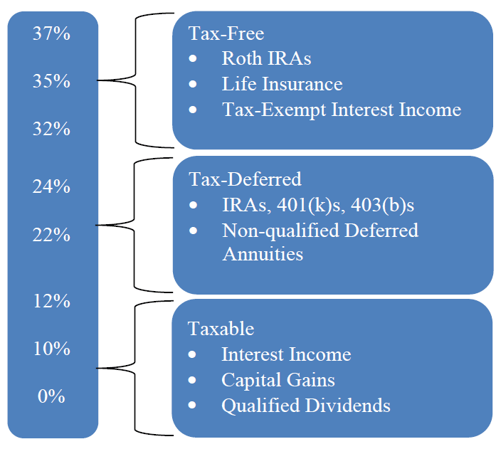

The first step in tax planning is to estimate the amount of taxable income over a five or fifteen-year horizon. Once the amount of taxable income is estimated, planning to avoid the higher tax brackets and the NIIT can begin. There are many different specific tax planning strategies that can be implemented depending on the situation. Some of these include:

Harvesting losses in high-income years;

Harvesting gains in low-income years;

Contributing to traditional IRAs in high-income years;

Contributing to Roth IRAs in low-income years;

Investing in tax-deferred annuities;

Creating different types of charitable remainder trusts;

Creating charitable lead trusts;

Engaging in installment sales;

Engaging in life insurance strategies;

Implementing Roth IRA conversions; and

Creating family trusts.

While some of those tax planning strategies may be quite complicated, the basic idea is simple –use income smoothing to obtain the maximum benefit of tax rate arbitrage. Basically, income smoothing strategies involve: (1) reducing taxable income in high-income years by maximizing deductions and shifting income to lower-income years; and (2) increasing income in low-income years by deferring deductions and increasing taxable income to fill up the lower tax brackets. Put another way, the idea is to keep taxable income below the highest tax rates and thresholds at which the effective tax rate increases.

Depending on the tax bracket one falls into, the strategy will be different.

Some of the top tax planning ideas include:

- “Filling-up” the 10% or 12% bracket;

- Doing Roth conversions by asset class and Roth conversions to manage tax brackets;

- Spending from the “outside non-qualified” portfolio first once you have “filled-up” the 12% bracket;

- Positioning bonds in IRAs because of the annual tax burden; and

- Using life insurance as a supplement to existing pensions.