Q: Betty inquired, “Dear Derek, I prefer to have more than one financial advisor, but I am wondering if I am being redundant and I was wondering if you could give me some insight on how I could reduce my fees and the cost associated with managing my wealth?”

A: Great question, Betty! Today, many retirees have been working with the same advisor for decades, but have exited the accumulation phase of their lives and now enter the important distribution and wealth transfer phase. One phase is about growth and the other is about income and taxes. Too often, the longtime advisor who may have a number of professional designations about retirement planning behind their names isn’t truly prepared to assist them with this new phase of life they have entered. Here’s a test, ask them if they can explain the differences between a CRUT or a CRAT and how that might be applicable to your distribution plan under the SECURE Act. Most will pause and even perhaps Google such info, but the reality is if they knew these details related to IRA distribution strategies they should embrace and run with your question immediately. If they pause, you know it may be time for a change. By the way, I answer that question in my response to Linda’s above question at www.miser-wp.com/dearderek.

So, you want to make sure you are paying for advice and not a middle man who is collecting a fee for being your representative at such places like Merrill Lynch, Wells Fargo, UBS, Morgan Stanley, or Charles Schwab. When was the last time they suggested any of the solutions that I cover in my above response to Linda’s question about IRAs and how to best transfer her wealth to her heirs under the new SECURE Act? In my opinion, you should be spending less than 1/5 of 1% or the equivalent of 0.20% to have your money managed annually. Overpaying in annual fees on your mutual funds takes an enormous bite out of your nest egg. The worst part is, you’re not paying for better results — as 96% of all actively managed mutual funds fail to beat the market. The average investor is simply overpaying for underperformance.

Nothing is more infuriating than to be told one price and then be paying another. Am I correct? Just like when you are buying a new car and then when it comes down to signing the final documents–a couple of thousand dollars in fees magically appear. Or when checking out of a hotel to find never discussed resort, internet fee, fees for towels, or valet fees that equate to another 50% of your overall bill. With the help of fine print, your advisor and the firm he/she works has hands down become the most masterful at hiding fees that you are paying without your awareness. For instance, in a recent Forbes article, “The True Cost of Owning a Mutual Fund,” Ty Pernikey, unveils that the average cost of such ownership is 3.17% per year. IF that doesn’t catch your attention, consider that wise investors can own 500 stop within the S&P 500 for around 0.014% or 14 basis points-That equates to just $0.14 for every $100 invested. That is a long way from $3.17 for every $100 invested, right? In different terms, that is over 22 times more expensive!

Here’s some scientific evidence that you a monkey most likely outperform your current advisor’s investment performance. Hiring a “professional money manager” is one of the biggest mistakes one can make when attempting to grow your wealth. Yes, they will send you a well-prepared newsletter expounding on their views of the market and what their “crystal ball” sees as the next coming boom, but in the end, they will consistently underperform market indexes. In 2013, Warren Buffett’s letter to Berkshire Hathaway’s shareholders stated that “when you look at results on an after-tax basis over a reasonably long period of time there is almost no chance that you end up beating an S&P 500 index fund.

Chasing Returns is Big Business

If you’re like most of my readers, you have already hit the proverbial financial “grand slam” through years of saving, investing, and/or inheritance. You have exited what I call the accumulation phase and entered into the distribution phase. Some are still stuck pursuing gains and don’t realize that the dangerous risks they are exposed to and how little impact it will have on their futures.

Distribution Phase

This financial phase requires a different special awareness and a different level of advice. This phase is about taxation and wealth transfer. I talk about the techniques that many should be evaluating in my recent blog, “Might the IRS have found a new way to tax my IRA by 40+% without telling me?” Here you’ll find real advice that offers true value to those in the distribution phase on how to transfer wealth and avoid needless taxation.

Being Smart

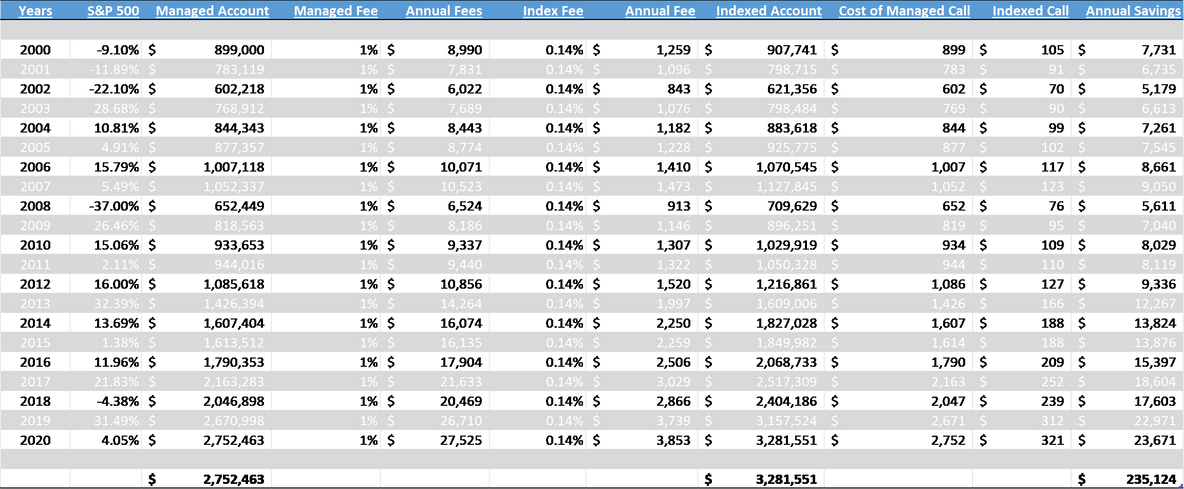

It is time that you begin paying for what you need and not what you don’t. Advisory firms often attempt to sink as many hooks into retirees’ lives, such as credit cards, mortgages, checking accounts, etc., only to lock them into overpaying for things that no longer add value to your life. Take for example you had a $1,000,000 account in 2000 and the fee you paid to have a friendly advisor call you 10 times a year was 1.0%. That means that each call costs you ~$1,000 per call. Now 20 years have passed, your account is now $3,000,000 and your fee is still 1.0% and the same call now costs you ~$3,000 per call! There is a 96% chance that your account would have grown more if you had simply invested in a low-cost 0.14% or less S&P 500 index fund and you would have saved over $235,000 in fees (see below chart). You would have accumulated over $500,000 in additional wealth and that is your advisor or professional money manager would have matched the annual performance of the S&P each year for the past 20 years.

The Tax Man Cometh

My advice would be to locate an advisor that is skilled in the design of wealth transfer and tax mitigation. If not planned for taxes will erode and significantly reduce your future lifestyle, as well as, the monies you transfer to heirs. One must locate an advisor that is aware of the proper techniques and who understands the nuances of the Secure Act and Cares Act, both of which were passed in the last 12 months. The result should be a strong peace of mind in the knowledge that you haven’t carelessly overlooked the pitfalls that others may fall victim to by continuing to rely on those accumulation advisors that they have worked with as they grew their wealth. The time is now to locate a new perspective, expertise, and hand to guide you through a new phase of wealth planning.