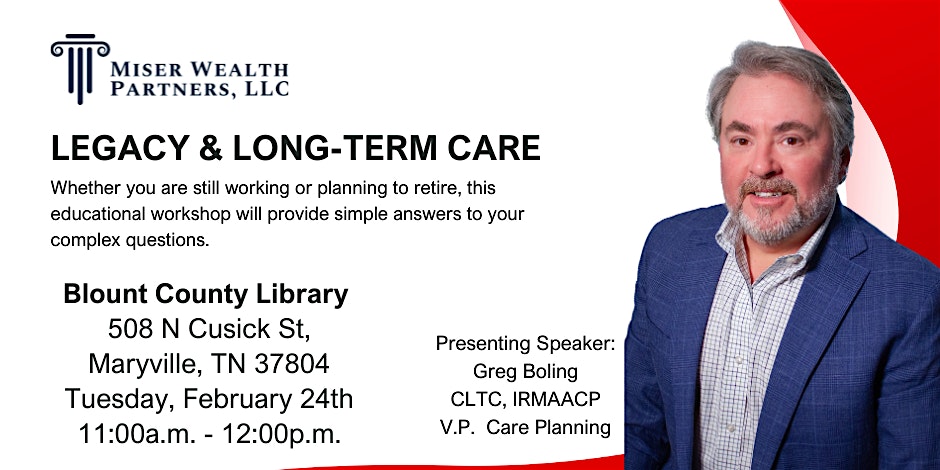

Educational Conversation on Legacy & Long-Term Care

February 24 @ 11:00 am - 12:00 pm

Join Greg Boling for a no-obligation educational discussion focused on Long-Term Care. Nothing will be sold at this event.

Join us for an exclusive educational conversation with Greg Boling, Vice President of Long-Term Care at Miser Wealth Partners, LLC, as we explore strategies about planning for long-term care and protecting what matters most.

While many firms focus only on investments, Miser Wealth Partners, LLC takes a more comprehensive approach. We help you safeguard your savings, plan for future healthcare and long-term care needs, and create a strategy designed to grow and adapt with you and your family.

During this event, you’ll gain valuable insights to help you navigate potential risks, protect your financial independence, and make informed decisions with confidence.

In this session, you will discover:

- How rising healthcare and long-term care costs could impact your savings—and the planning options available to help protect them.

- How to align your financial, legal, and personal wishes to ensure your care and legacy are carried out the way you intend.

- How long-term care insurance can help cover expenses not typically paid by health insurance, Medicare, or Medicaid.